|

|

Post by robjh22 on Oct 27, 2021 8:45:49 GMT -5

I support, in principal, the idea of a wealth tax. Wealthy conservative Republican investor Ben Stein ("Bueller? ... Anyone?") called for it many years ago, this to support pay increases for the military. I think Bill Gates and Warren Buffet would support it as well. (I'm just like them, see?)

I had some doubts because of the strong possibility that taxed assets this year may decrease in value next year. Also, I dislike most of the pols calling for it, and so my reflex is to say that it has to be wrong, just as the vice president's reflex was to refuse the "Trump vaccine." Dumb in both cases. (Part of me hopes Trump runs against Harris in 2024 only so that he can ask her, in the debates, "Did you and your family end up taking 'my' vaccine in 2021?")

But then it occurred to me that the least among us in Texas, wealth-wise, pay substantial tax on the appraised value of our homes, this to pay for public schools and streets. Even if you don't have children in public schools, even if the property is not generating income, even if you're middle class, you pay. If you rent, the landlord pays and passes it on to you. One way or the other, you pay tax on part of your wealth in Texas, be it ever so humble. Your wealth, I mean.

It's a very substantial tax, but we have no income tax here, so it's a wash. If the value of your house goes down next year, you pay less. You do not get a refund of the taxes paid in the previous year. What's the difference between my paying tax on the always changing appraised value of my house and Jeff Bezos paying tax on the always changing market value of his Amazon stock? He can pick the date on which the appraisal is made, or he can elect to pay based on the average of closing values over the entire fiscal year, so long as he doesn't make some whacky announcement the day before to tank and devalue Amazon stock, this in order to reduce his basis for tax purposes.

I do hate this "fair share!" mantra, because it's utterly subjective. But the ultra wealthy have an enhanced interest in insuring stability and preserving the status quo, and that means helping to fund the government, even if they don't realize (by sale and profit taking) any income from it.

Harrumph!

|

|

|

|

Post by Marshall on Oct 27, 2021 9:00:14 GMT -5

Taxes are a shell game.

It'd be interesting to see a breakdown by state and economic status as to what everyone's burden for Federal, state, and local services is. But I'm too lazy (and confused) to look it up.

You do it.

|

|

|

|

Post by aquaduct on Oct 27, 2021 9:03:53 GMT -5

I don't support anything that comes out of DC because of the unmistakable smell of horseshit covering it. The system long ago lost brakes and voters simply have no say in anything they do there.

It's even worse when the self aggrandizing blatant liars are in charge like they are now. "Wait a minute Joe! Before you push some new f**k up on me, let's go back and honestly assess the last 10 months of f**k ups and try to get to some accountability.

Yeah, property taxes, etc. are similar but I know the people imposing them and can talk with them when I see them in the supermarket.

|

|

|

|

Post by majorminor on Oct 27, 2021 9:04:45 GMT -5

Well as government takes more and more at least things get better right?

|

|

|

|

Post by aquaduct on Oct 27, 2021 9:22:15 GMT -5

Well as government takes more and more at least things get better right? Well Biden's building a wall (around one of his homes anyways) so obviously it's getting better for him. |

|

|

|

Post by Hobson on Oct 27, 2021 9:35:10 GMT -5

No. I haven't seen any mention of getting a refund when the value of the assets goes down. Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement.

|

|

|

|

Post by robjh22 on Oct 27, 2021 10:02:28 GMT -5

Well as government takes more and more at least things get better right? No, but there are two sides of a slippery slope. We can no more increase taxes to 100% than we can reduce them to zero. So the ideal number is somewhere between 0 and 100. And the question is, what is that number? |

|

|

|

Post by majorminor on Oct 27, 2021 10:03:18 GMT -5

I haven't seen any mention of getting a refund when the value of the assets goes down. It's been reported that losses are deductible too under the provision with no specifics given. "Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement" Is there anyone here he thinks that WON'T be the next logical progression? You are 100% correct IMO. This particular tax legislation being proposed is ridiculous. We not only want a bite of your real profits now we'd like a chunk of the theoretical ones as well? Gimme a break. A tax break. |

|

|

|

Post by robjh22 on Oct 27, 2021 10:08:36 GMT -5

No. I haven't seen any mention of getting a refund when the value of the assets goes down. Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement. That's true, no guarantee, and I can see certain members of congress calling for exactly that, but they are not at present, and I'll fight on that hill with you if and when they do. But again, what is the difference (in principle) between property tax and a wealth tax? |

|

|

|

Post by theevan on Oct 27, 2021 10:09:38 GMT -5

No. I haven't seen any mention of getting a refund when the value of the assets goes down. Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement. Reminiscent of the wee, little itty-bitty income tax (when introduced) that isn't so itty-bitty now... |

|

|

|

Post by robjh22 on Oct 27, 2021 10:13:06 GMT -5

I haven't seen any mention of getting a refund when the value of the assets goes down. It's been reported that losses are deductible too under the provision with no specifics given. "Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement" Is there anyone here he thinks that WON'T be the next logical progression? You are 100% correct IMO. This particular tax legislation being proposed is ridiculous. We not only want a bite of your real profits now we'd like a chunk of the theoretical ones as well? Gimme a break. A tax break. Yes, I think that what is being proposed will not progress to a tax on 401k's while they just sit there in your Fidelity account doing nothing except increasing and decreasing with market fluctuations. Now, it may be that the tax on the withdrawals from a 401k after age 70 may increase, but that's not the same thing. |

|

|

|

Post by robjh22 on Oct 27, 2021 10:15:04 GMT -5

To clarify something, I am only referring to increasing taxes on you all, not on myself.

My taxes should be reduced, and when I am King, they will be.

Hold me to it!

|

|

|

|

Post by robjh22 on Oct 27, 2021 10:17:38 GMT -5

Taxes are a shell game. It'd be interesting to see a breakdown by state and economic status as to what everyone's burden for Federal, state, and local services is. But I'm too lazy (and confused) to look it up. You do it. I'll get right on that. |

|

|

|

Post by majorminor on Oct 27, 2021 10:27:15 GMT -5

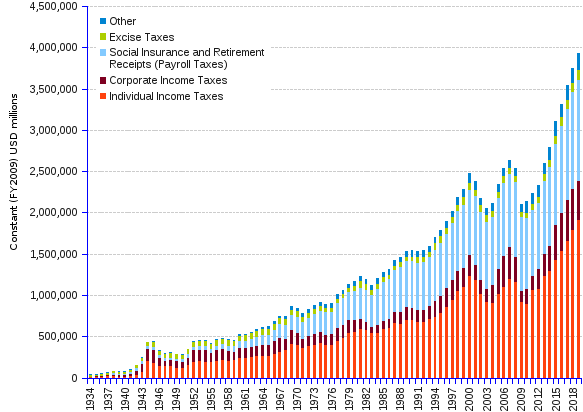

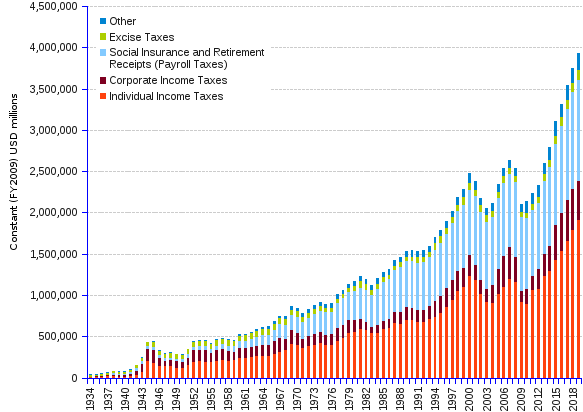

|

|

|

|

Post by robjh22 on Oct 27, 2021 10:29:20 GMT -5

No. I haven't seen any mention of getting a refund when the value of the assets goes down. Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement. Reminiscent of the wee, little itty-bitty income tax (when introduced) that isn't so itty-bitty now... For the ultra rich, it actually is itty-bitty as compared to the top marginal rates in the Eisenhower years. Conservatives are quick to note that "almost nobody actually paid the 90% marginal rate in place during the 50's" (because of then-existing shelters). That's true, it wasn't effectively 90% when the dust settled, but even with the elimination of shelters when Reagan (and Kennedy before him) reduced top marginal rates, the effective rate was still substantially higher than it is today (40, 50, 60%). www.google.com/amp/s/www.aier.org/article/the-rich-never-actually-paid-70-percent/amp/ |

|

|

|

Post by aquaduct on Oct 27, 2021 10:38:06 GMT -5

No. I haven't seen any mention of getting a refund when the value of the assets goes down. Also, it starts out as a tax on billionaires, but there's no guarantee that it won't start applying to the 401(k)s of those who were willing and able to save for their retirement. That's true, no guarantee, and I can see certain members of congress calling for exactly that, but they are not at present, and I'll fight on that hill with you if and when they do. What do you think you can do to fight it if it comes to that? |

|

|

|

Post by robjh22 on Oct 27, 2021 10:50:55 GMT -5

I haven't seen any mention of getting a refund when the value of the assets goes down. We not only want a bite of your real profits now we'd like a chunk of the theoretical ones as well? Gimme a break. A tax break. It's no different from the tax on the ever-increasing appraised value of your theoretical profits on your as yet unsold house, as far as I can see. |

|

|

|

Post by majorminor on Oct 27, 2021 11:21:18 GMT -5

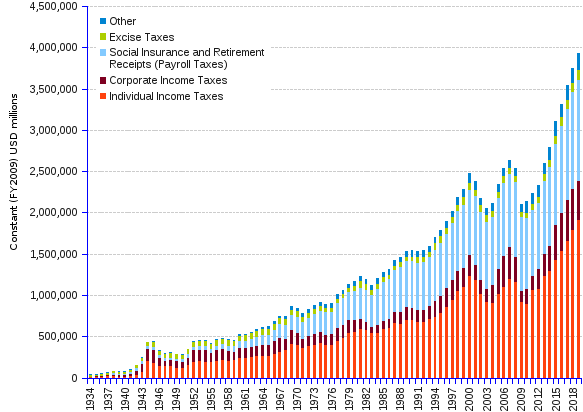

We not only want a bite of your real profits now we'd like a chunk of the theoretical ones as well? Gimme a break. A tax break. It's no different from a tax on the appraised value of your house, as far as I can see. I don't quite follow the point you are trying to make beyond the similarities between the two vehicles to collect tax. Other than the obvious where the money goes difference yeah they are similar in that a levy is based a theoretical unrealized appraised value at some point in time. So what? Nobody is supposed to be pissed about theoretical IRA or 401K profits being taxed beforehand because we all pay property taxes? Two wrongs don't make a right and all that. The difference that matters is we've been chugging along about as well as can be expected all playing by a certain set of rules. In this time frame - let's call it post WW2 to now - collected federal revenues are 45 degree angle up. Are you feeling like you are getting excellence for your increased share of taxes paid? Do you think another bite another way is going to make things better? I think that's at the core of people who bristle at tax increases. It seems to the lay person a system is in place that pisses a lot of money away, then gets to rig the system to get more money rather than living within "it's" means. You know....like we do. In addition to the OSHA shakedown every few years I pay property taxes, sales tax, county mill levy's, personal and business tax, state income tax, fed income tax, FICA, personal property tax, capital gains tax, tobacco tax(not any more for me), gas tax, car registration, ATV registration, hunting and fishing licenses. I'm sure I'm missing 5 or 6 ways a Fed or State entity is skimming money. Jesus - how much more you want?  |

|

|

|

Post by Russell Letson on Oct 27, 2021 11:32:53 GMT -5

Given the slippery nature of labels used by politicians, marketers, car salesmen, and dietary-supplement floggers, it would be useful to know exacty what is in the package being promoted. And of course the devil is always in the details--the exact ingredients listed in tiny type on the label. "Wealth" in various current conversations is being applied to everything from the Scrooge McDuck-style money vault to the (mortgaged) family homes of wage-earners. And deployed by people on the left, this is the kind of sloppy semantics that offers opportunities to people on the right. (Don't get me started on the semantic-rhetorical strategic fuckup of "Black Lives Matter.") On the one hand there are the very rich and politically well-connected who have devised ways of walling off from taxation or even visibility large portions of their assets--including not just savings but productive assets. On the other hand, there are people we used to call "comfortable" whose assets consist of a paid-for home, a pension, and what we used to quaintly call "life savings" or the "nestegg." Some of the monetary assets might even be in the form of equity holdings and thus "productive." (For example, we hold a handful of stocks, purchased decades ago, that generate dividends, on which we pay taxes.) Everything listed in the above paragraph constitutes "wealth," but at some point the quantity and the configuration of the assets becomes a qualitative difference. The wealth of the billionaires of the world is not exposed to taxation in the same way that the homes and savings and retirement accounts of, say, the doctors and lawyers and landlords that my father would have seen as "rich." (And who were actually merely very comfortable.) So--if a "wealth tax" means changing the way corporations and the extremely rich shelter their assets from taxation, I say have at it. But we should be careful what we wish for and read the small-print ingredients list very carefully.  |

|

|

|

Post by robjh22 on Oct 27, 2021 11:36:00 GMT -5

It's no different from a tax on the appraised value of your house, as far as I can see. I don't quite follow the point you are trying to make beyond the similarities between the two vehicles to collect tax. Other than the obvious where the money goes difference yeah they are similar in that a levy is based a theoretical unrealized appraised value at some point in time. So what? Nobody is supposed to be pissed about theoretical IRA or 401K profits being taxed beforehand because we all pay property taxes? Two wrongs don't make a right and all that. The difference that matters is we've been chugging along about as well as can be expected all playing by a certain set of rules. In this time frame - let's call it post WW2 to now - collected federal revenues are 45 degree angle up. Are you feeling like you are getting excellence for your increased share of taxes paid? Do you think another bite another way is going to make things better? I think that's at the core of people who bristle at tax increases. It seems to the lay person a system is in place that pisses a lot of money away, then gets to rig the system to get more money rather than living within "it's" means. You know....like we do. In addition to the OSHA shakedown every few years I pay property taxes, sales tax, county mill levy's, personal and business tax, state income tax, fed income tax, FICA, personal property tax, capital gains tax, tobacco tax(not any more for me), gas tax, car registration, ATV registration, hunting and fishing licenses. I'm sure I'm missing 5 or 6 ways a Fed or State entity is skimming money. Jesus - how much more you want?  I concede that if all property taxes are "wrong," though I don't think they are, then there is no inconsistency in also opposing wealth taxes. But it seems to me that similar arguments can be and are made against all taxes -- sales, income, excise, and capital gains. I also grant that there is a problem/unfairness with property taxes on a homestead in some cases. Grandma bought her house in 1950 for $7,000. Now it's worth $500,000 due to location. There has to be some consideration for her faultlessness in the increase when it comes to property taxation. She has to come up with that property tax payment from somewhere, and she's old, widowed, and disabled and can't work, and she shouldn't have to sell the house. My only point in referencing property taxes is to rebut my own earlier complaint about the wealth tax. If I'm consistent, I can't make the argument I was making. |

|